Great Deceiver

Arcane

- Joined

- Aug 10, 2012

- Messages

- 5,914

I didn't know Titan Quest 2 had been announced. By Spellforce 3 devs? Could be decent (fabulously optimistic)

Duke and Saints Row are the only thing of value in that shit company, both have lost loads of value over the years, and they could easily be excluded from the salehttps://www.bloomberg.com/news/arti...group-looks-to-sell-video-game-studio-gearbox

Embracer Group Looks to Sell Video Game Studio Gearbox

The game developer is best known for Borderlands, which has generated more than $1 billion in revenue

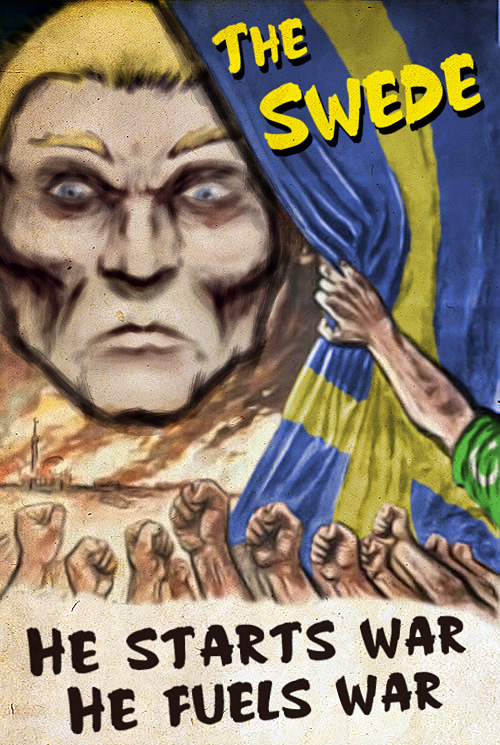

Swedish video-game conglomerate Embracer Group AB is looking to sell Gearbox Entertainment just two-and-a-half years after purchasing the studio for $1.3 billion. Gearbox will also explore other options including spinning it off, the company said in an email to staff Monday morning.

The Frisco, Texas-based game developer is best known for Borderlands, a video-game series that has sold 77 million copies and generated more than $1 billion in revenue. Reuters first reported the potential sale.

“The base case is that Gearbox remains a part of Embracer,” wrote Gearbox Chief Communications Officer Dan Hewitt in an email to staff seen by Bloomberg. “However, there are many options under consideration, including Gearbox’s transfer, taking Gearbox independent, and others. Ultimately, we’ll move ahead with whichever path is best for both Gearbox and Embracer.”

Embracer has spent the past few years snatching up game studios all across the world but this year began a period of reorganization following a failed $2 billion deal with Saudi Arabia’s gaming group. This month the company closed down Illinois-based game studio Volition and laid off staff all across its other divisions.

“Nothing has been decided yet, but there will be a lot of speculation in the coming weeks,” Hewitt wrote.

Imagine thinking you can wrestle with the Grease Man.https://www.bloomberg.com/news/arti...group-looks-to-sell-video-game-studio-gearbox

Embracer Group Looks to Sell Video Game Studio Gearbox

The game developer is best known for Borderlands, which has generated more than $1 billion in revenue

Swedish video-game conglomerate Embracer Group AB is looking to sell Gearbox Entertainment just two-and-a-half years after purchasing the studio for $1.3 billion. Gearbox will also explore other options including spinning it off, the company said in an email to staff Monday morning.

The Frisco, Texas-based game developer is best known for Borderlands, a video-game series that has sold 77 million copies and generated more than $1 billion in revenue. Reuters first reported the potential sale.

“The base case is that Gearbox remains a part of Embracer,” wrote Gearbox Chief Communications Officer Dan Hewitt in an email to staff seen by Bloomberg. “However, there are many options under consideration, including Gearbox’s transfer, taking Gearbox independent, and others. Ultimately, we’ll move ahead with whichever path is best for both Gearbox and Embracer.”

Embracer has spent the past few years snatching up game studios all across the world but this year began a period of reorganization following a failed $2 billion deal with Saudi Arabia’s gaming group. This month the company closed down Illinois-based game studio Volition and laid off staff all across its other divisions.

“Nothing has been decided yet, but there will be a lot of speculation in the coming weeks,” Hewitt wrote.

I was under the impression the SR2 patch was being done under Gearbox.Saints Row is owned by Deep Silver, they kept the IP.

Embracer Group layoffs hit Tomb Raider developer Crystal Dynamics

As part of "internal restructuring".

Tomb Raider developer Crystal Dynamics has confirmed ten employees have lost their jobs as part of an "internal restructuring" programme, following multiple accounts from employees that the studio had been hit with lay offs today.

Senior brand manager Nicholas Edwards announced his departure from Crystal Dynamics in a message shared on LinkedIn, revealing he was "one of a number of people impacted by the latest round of Embracer layoffs" at the studio. Edwards noted today's job cuts had affected a broad spread of departments, including PR, project management, 2D art, and video editing.

Crystal Dynamics' communications director Adam Kahn also confirmed he'd been affected by today's layoffs, as did senior community and social media manager Neha Nair. "After 3.5 years at Crystal Dynamics," Nair wrote, "I was laid off today."

Following those initial employee accounts of layoffs at Crystal Dynamics, the studio - which is currently working on a new Tomb Raider game for Amazon and assisting with Microsoft's Perfect Dark reboot - confirmed the news on social media.

"Crystal Dyanmics made the difficult decision to part ways with nine brand/marketing and one IT employee today due to an internal restructuring to align the studio with our current business needs," it wrote. "We are working directly with the affected staff to support them."

News of today's layoffs comes as Crystal Dynamics owner Embracer Group continues its previously announced "comprehensive restructuring programme" in light of ongoing financial challenges. Last month Embracer revealed it would be shutting down Saints Row developer Volition Games "effective immediately", and news began circulating last night that 26 employees at the Embracer-owned Beamdog, the studio behind the recently released Mythforce, had lost their jobs on Friday.

Additionally, Embracer confirmed it was considering selling Borderlands developer Gearbox as part of its restructuring efforts earlier this month, while yesterday saw the Embracer-owned Saber Interactive announce it would be ceasing development on last year's multiplayer Evil Dead game, and that a planned Switch version has now been cancelled.

DeepL said:"It was inhumane": brutal cutbacks at legendary Hungarian game studio

Zen Studios, one of the greatest legends of Hungarian game development, is now under Swedish ownership. Now, Forbes.hu has learned that more than a quarter of the team has been sent home.

On Friday, more than 30 employees of the legendary Hungarian game studio Zen Studios were invited to a short Zoom meeting. They were fired for "economic reasons" and "internal reorganisation", several former colleagues who asked not to be named confirmed to Forbes.hu. According to our information, some employees were dismissed after 15 years of service.

We heard "silence and tears" followed the conference call, which was "terse, blunt, dry facts" and lasted no longer than ten minutes. "It was inhumane," said one of our sources, who said the HR department had officially informed them in writing of the firing of 32 employees.

"It was quite unexpected for everyone," added another source.

According to the latest figures available on Partnercontrol, Zen Studio Ltd has 121 employees (plus freelancers). We understand that all the ex-colleagues concerned were full-time employees, which means that more than 26% of the workforce has been sent home. On LinkedIn, several Zen employees have posted on their profiles since Friday that they are looking for a new job.

Early Saturday afternoon we sent questions to Zen Studios for confirmation or comment. We specifically asked about the official reasoning, the exact number of fired colleagues, whether the cutbacks affect only the Budapest studio or also their US offices, and whether this has anything to do with the recently announced so-called "restructuring program" of the Swedish parent company, Embracer Group.We will update this article as soon as we receive an answer.

Legendary pinball studio

Founded in 2003, Zen is known primarily for its pinball games, having created virtual tables from superhero franchises such as Star Wars, Marvel and South Park.Their story was featured in the September 2020 Forbes magazine. Zen Studio Ltd. had revenues of nearly HUF 2.6 billion in 2022 (also above HUF 2.5 billion in 2021), but its profit after tax almost halved from over HUF 1 billion in 2021 to HUF 560 million in 2022.

Also at the end of 2020, we wrote on Forbes.hu that the Swedish Embracer group had acquired the company through a subsidiary, Saber Interactive. According to the announcement at the time, Zen continued to operate as an independent studio under Saber. The over-hiring trends during the covid have not escaped Zen, with the headcount nearly doubling since the acquisition news in 2020, with 2020 ending with only 67 employees compared to the current (pre-downsizing) 121.

For a long time, Embracer was perhaps the largest globe in the industry. For several years, the gaming press was full of stories of tons of money being bought up and spent on game development studios or video game companies around the world. Another of their Hungarian acquisitions was Digic, also linked to the late Andy Vajna, and last year Forbes.hu asked founder-CEO Alex Sándor Rabb about the acquisition.

Plan gone up in smoke

Embracer's mad dash to spend money (which even included the rights to The Lord of the Rings) was interrupted by a very strange announcement.

In May this year, it was announced that a two billion dollar mega deal had fallen apart at the last minute - Axios understands that a deal with the video game subsidiary of the Saudi government's sovereign wealth fund had fallen through.

The announcement sent Embracer crashing to the floor of the stock market, and the company has announced a so-called "restructuring programme", which could involve cutting costs, cutting projects and closing studios.

As a result, several Embracer studios have undergone restructuring in recent months, with people being sent home from Crystal Dynamics, the developer of the Tomb Raider games, and the closure of Volition, the creator of the Saints Row games. The latest iteration of the latter has not been warmly received by gamers or the press.

We understand that it was not specifically stated at the recent Zoom meeting that the layoffs had anything to do with this restructuring. Indeed, no official communication has yet been received from either Zen or Embracer.

Operencia was a decent Wizardry-like, which was a promising first RPG from a developer known for pinball simulators, and it's a disgrace the company was acquired by THQ Nordic.But yeah, operencia was okay ish and i enjoyed playing itm RIP maybe.

ffsTimeSplitters developer Free Radical Design is at threat of being closed by owner Embracer Group, just two years after it was re-established, sources have told VGC.

Results from Embracer:

- A bit better than expected.

- The restructuring program has resulted in a reduction of around 900 staff, 5% of its workforce, and the discontinuation of several studios and projects.

- Mixed reception and performance for Payday 3.

- Multiple divestments and/or external investments are very likely happening:

In the past months, we have accelerated processes to divest assets relative to processes to increase external funding of game development projects. This shift is driven primarily by a notable inbound interest, but also by market dynamics and reduced levels of platform content investments. As a result, we are now running a few structured divestment processes that give us flexibility and optionality to reach our targets. We are focused on maximizing shareholder value and on delivering the targeted run-rate capex levels in the most effective way. Notable capex savings and net debt reduction are expected to materialize post-completion of these processes.

- Internal consolidation is happening too:

Right now we are in the early stages of our plans to consolidate our businesses, including a review of our operative group structure, which is part of the late stages of the restructuring program. We have a responsibility to use our size and talent in smart ways to develop and scale services and capabilities across Embracer

to deliver always better experiences for players.

They have 12 operative groups (Gearbox, Crystal Dynamics/Eidos or Saber are independent groups, for example). I guess that more than one is going to be consolidated.

Meanwhile, the whole industry is getting raped by the job-creator class...

A reminder that while videogames this year are AMAZINGLY GOOD

Are the layoffs happening at the "good" companies or elsewhere? The success of a handful of studios does not mean success for other studios.Meanwhile, the whole industry is getting raped by the job-creator class...

Meanwhile, the whole industry is getting raped by the job-creator class...

A reminder that while videogames this year are AMAZINGLY GOOD

Embracer: Human cost of restructure is "significant" but "necessary"

Phil Rogers discusses the group's goals and progress following the dismissal of more than 900 staff

To say it's been a rough year for the games industry's workforce is putting it mildly; thousands of jobs have been lost as companies restructure and downsize following rapid growth during the onset of the pandemic.

Perhaps this is most prominently demonstrated by the ongoing restructure of Embracer Group, where expansion was not limited to the last few years. Since 2017, the company has acquired almost 90 businesses, ranging from smaller developers like Zen Studios, to AAA studios such as Gearbox and Crystal Dynamics, to non-games firms like tabletop leader Asmodee, comics publisher Dark Horse Media, and even Lord of the Rings owner Middle-Earth Enterprises.

The industry has been watching Embracer carefully, waiting to see if its Jenga tower of M&A purchases will eventually topple – and that moment seemed to arrive earlier this year after the group announced a deal expected to be worth at least $2 billion had collapsed due to the last-minute withdrawal of its unknown partner.

The restructuring program, along with plans to reduce the company's net debt of $1.5 billion, began in June and Embracer gave its first significant progress update alongside its financial results last week. That debt had been reduced to $1.4 billion, with the group saying it was on track to bring it down to $757 million by the end of the fiscal year in March 2024.

The restructure has primarily been in the PC/console areas of the business, with Embracer's financial report stating that the stability and predictability of the mobile, tabletop and entertainment segments have bolsetered their results. However, Board Game Wire reports restructuring has now begun at tabletop firm Asmodee. [Embracer has since reached out to claim these comments referred to Embracer as a whole, not specifically Asmodee]

The human cost of Embracer's debt reduction has been steep. 904 people were laid off between July 1 and September 30, with more dismissed since due to redundancies at three more of its studios across October and November. And there's more to come.

In the wake of the results, we speak with Embracer's Phil Rogers, interim chief strategy officer and CEO of the operating group that includes Crystal Dynamics and the other Western studios previously owned by Square Enix, where Rogers worked until last year's acquisition.

Rogers points to the status of the overall restructure, reiterating the financial reports' perspective that Embracer is "making good progress."

"I think these sort of reporting dates are good times to stand up and sort of say, you know, how do we feel we're doing against it? We feel good," he tells GamesIndustry.biz. "We feel like we're on track against our targets that we've set out. So we feel very positive about that.

"We're in line with our targets on how we bring the debt down, with [operating expenses] savings and the targets for our capital expenditure, which is basically our games pipeline. And obviously we're going to readjust that games pipeline down to the run rate we talk about is SEK 5 billion ($478.4 million) going into next fiscal year. Those adjustments are very, very clear and well understood targets for us. So I think we're making good progress against that."

He goes on to say that restructuring can be introspective for a company, giving great consideration to the business' goals, ambitions and, as Rogers puts it, "how we win."

"We talk about how we improve our efficiency, our cash generation. How do we transform ourselves into a leaner, stronger, more focused and – critically – cash self-sufficient company? And I think these have been really good challenges for the whole business to lean into. It's got a lot of good conversations going across the business."

That said, Rogers recognises the human cost of this process. "There's a lot of it going around the industry at the moment of restructuring, but the downside, obviously, is the impact on people. It's something that really Embracer feels for.

He continues: "It's been an agonising process to see the sort of headcount [reduction], but we know it's a necessary thing for us to hit our new and needed goals. So overall, good progress and we push on."

Rogers echoes Embracer's previous announcement that it would do a complete review of its global pipeline, which is "a big pipeline." That's no understatement: as recently as June 2023, Embracer announced it has over 200 games in development across its various studios.

"Embracer has got one of the broadest and deepest games pipeline in the industry, I think," Rogers says. "It was very interesting [in the review] to get experts and eyes from all across the different operating units and really work together on one project, to look at our pipeline and work out how we assess it all, what we think about it.

"It got a lot of people introduced to one another, people who've been working in different parts of the group to actually build up their networks and whatnot and get a lot of communication going. So I think there's been a lot of positives from that overall programme."

It's an unusual time to be conducting such a review. 2023 is a year in which the biggest games – Zelda, Hogwarts Legacy, Diablo, Spider-Man, etc – are performing better than ever, while more and more players are pouring the majority of their time into live services. It seems harder than ever to have a hit outside the AAA space, which is where the majority of Embracer's studios operate. Even its biggest release in years, the 2022 revival of Saints Row, failed to meet expectations.

In such a climate, how does a business decide which of its 200+ in-development games are worth continuing?

The return of Saints Row was the biggest release from an Embracer company in years, but it still failed to meet sales expectations

"First and foremost, we look at entertainment values," says Rogers. "It has to be fun to play. I'm never a big fan of the 'fewer bigger, better' [approach]. Bigger games aren't always fun. I know how hard it is to make smaller games and to bring those entertainment values to bear from experience at Crystal when we started working on digital spin-outs of Lara Croft. For Lara Croft and the Temple of Osiris, that was a AAA team trying to make a game with much, much smaller budgets. So many teams are producing games today for much, much smaller budgets.

"Then we do look at how we would assess the commercial outcomes, how we squint and would see those returns. There's the potential for genres as well, where we've got overlap in potential genres or whatnot… That would help us make some decisions. "It also helps us explain decisions with teams. One of the softer but very clear advantages of going through this process I found is it really has got teams to work together to share, to discuss, and that's helped us then with those decisions when we've had to deliver them."

For Rogers, that strategy was built on the ambition to position Embracer as an industry leader and the company wants to maintain that leadership position.

"Establishing ourselves within the the industry… [Embracer is] a relatively new player, but then in other aspects, Embracer has been around for a while," he says. "But its emergence amongst the leadership in the industry has been a very fast ascent."

Rogers brings an interesting perspective to the matter. Having only joined Embracer last year, he saw that very fast ascent from an external point of view, and now he's seeing the next chapter internally. When asked what led Embracer to this point, he relates it to the wider games business and its rapid growth.

"We're a super-confident industry, a boundary-pushing industry," he explains. "I joined in 1999 with the belief that physics middleware was gonna revolutionise gameplay, and now I realise it's just a component of how games are designed and enjoyed. This is an industry that's always taking on and facing challenges, always looking for opportunities, entertaining billions of people around the world, and it's growing…I think I recognise all of that within Embracer."

He continues: "[But] part of that confidence means that at times, we have to change and adapt. You know, the macro forces and micro forces. I think that's the situation that the industry is in right now. We've taken on a lot, but it's in that pursuit to change and evolve and grow, and now we're just in that different climate. And I think that maps across absolutely with Embracer. It is a very confident and can-do organisation, but now we just got to face some of the realities of how we can work in a more efficient way."

We bring the conversation back to what the group's goals are, what 'winning' looks like to Embracer, to which Rogers responds: "These are all questions we are going to come back to and address in full. We're very focused right now on the restructuring, So I don't think these are questions we are in a position to answer today. He continues "We are very focused on the restructuring. I think it is a very galvanising time for us. Personally, I think we learn more about ourselves in tough times. It's when you really have to think deeply and without any complacency. And I said today, we try and bring people together in this focused programme now, and [we] will come out with that meta vision as we get into 2024."

Embracer owns a lot of valuable IP, including Tomb Raider and The Lord of the Rings

As Embracer stated in its financial report, the restructure is still in its "early stages," which means more layoffs and studio closures are expected. How many more is still unclear.

"It's always a tricky question," says Rogers. "We report to the quarter, and we're mindful that the operative groups are making changes. Some of that makes the news, and some of it doesn't. We don't comment on that, but we will report on it as we get to those quarterly measurement dates, so the next time will be in February.

Embracer also has spent much of the past five months reassessing the inefficiencies that brought the business to this point. From the outside in, it's fairly easy to suggest an aggressive M&A strategy of nearly 90 purchases in six years is the primary factor – especially without major hits from the studios it does own to help sustain a group of this size.

"Our priorities are… very much keeping a focus on working together, keeping eyes on the goal at a project level. We have announced that we expect more restructuring and some more cancellations, potentially some more closures or management buyouts. That's the balance we've got to take internally… Because, as we say, the people cost is significant, and it's significant to us and we have to handle that always with that respect and integrity."

Rogers concludes by reiterating that Embracer is very much focused on looking forward, and while it's adjusting how it operates, the company's long-term vision is still unchanged.

"We have a solid foundation with predictable, profitable, and cash-generative businesses, including a roster of renowned PC/Console franchises that gradually grow stronger," he says. "The demand for content has never been greater, and we are well-positioned to leverage that demand. We have fantastic people and many world-class IPs, and we aim to demonstrate the growing earnings power of this combination over time."

https://www.gamesindustry.biz/embracer-human-cost-of-restructure-is-significant-but-necessary

Embracer: Human cost of restructure is "significant" but "necessary"

Phil Rogers discusses the group's goals and progress following the dismissal of more than 900 staff

To say it's been a rough year for the games industry's workforce is putting it mildly; thousands of jobs have been lost as companies restructure and downsize following rapid growth during the onset of the pandemic.

Perhaps this is most prominently demonstrated by the ongoing restructure of Embracer Group, where expansion was not limited to the last few years. Since 2017, the company has acquired almost 90 businesses, ranging from smaller developers like Zen Studios, to AAA studios such as Gearbox and Crystal Dynamics, to non-games firms like tabletop leader Asmodee, comics publisher Dark Horse Media, and even Lord of the Rings owner Middle-Earth Enterprises.

The industry has been watching Embracer carefully, waiting to see if its Jenga tower of M&A purchases will eventually topple – and that moment seemed to arrive earlier this year after the group announced a deal expected to be worth at least $2 billion had collapsed due to the last-minute withdrawal of its unknown partner.

The restructuring program, along with plans to reduce the company's net debt of $1.5 billion, began in June and Embracer gave its first significant progress update alongside its financial results last week. That debt had been reduced to $1.4 billion, with the group saying it was on track to bring it down to $757 million by the end of the fiscal year in March 2024.

The restructure has primarily been in the PC/console areas of the business, with Embracer's financial report stating that the stability and predictability of the mobile, tabletop and entertainment segments have bolsetered their results. However, Board Game Wire reports restructuring has now begun at tabletop firm Asmodee. [Embracer has since reached out to claim these comments referred to Embracer as a whole, not specifically Asmodee]

The human cost of Embracer's debt reduction has been steep. 904 people were laid off between July 1 and September 30, with more dismissed since due to redundancies at three more of its studios across October and November. And there's more to come.

In the wake of the results, we speak with Embracer's Phil Rogers, interim chief strategy officer and CEO of the operating group that includes Crystal Dynamics and the other Western studios previously owned by Square Enix, where Rogers worked until last year's acquisition.

Rogers points to the status of the overall restructure, reiterating the financial reports' perspective that Embracer is "making good progress."

"I think these sort of reporting dates are good times to stand up and sort of say, you know, how do we feel we're doing against it? We feel good," he tells GamesIndustry.biz. "We feel like we're on track against our targets that we've set out. So we feel very positive about that.

"We're in line with our targets on how we bring the debt down, with [operating expenses] savings and the targets for our capital expenditure, which is basically our games pipeline. And obviously we're going to readjust that games pipeline down to the run rate we talk about is SEK 5 billion ($478.4 million) going into next fiscal year. Those adjustments are very, very clear and well understood targets for us. So I think we're making good progress against that."

He goes on to say that restructuring can be introspective for a company, giving great consideration to the business' goals, ambitions and, as Rogers puts it, "how we win."

"We talk about how we improve our efficiency, our cash generation. How do we transform ourselves into a leaner, stronger, more focused and – critically – cash self-sufficient company? And I think these have been really good challenges for the whole business to lean into. It's got a lot of good conversations going across the business."

That said, Rogers recognises the human cost of this process. "There's a lot of it going around the industry at the moment of restructuring, but the downside, obviously, is the impact on people. It's something that really Embracer feels for.

He continues: "It's been an agonising process to see the sort of headcount [reduction], but we know it's a necessary thing for us to hit our new and needed goals. So overall, good progress and we push on."

Rogers echoes Embracer's previous announcement that it would do a complete review of its global pipeline, which is "a big pipeline." That's no understatement: as recently as June 2023, Embracer announced it has over 200 games in development across its various studios.

"Embracer has got one of the broadest and deepest games pipeline in the industry, I think," Rogers says. "It was very interesting [in the review] to get experts and eyes from all across the different operating units and really work together on one project, to look at our pipeline and work out how we assess it all, what we think about it.

"It got a lot of people introduced to one another, people who've been working in different parts of the group to actually build up their networks and whatnot and get a lot of communication going. So I think there's been a lot of positives from that overall programme."

It's an unusual time to be conducting such a review. 2023 is a year in which the biggest games – Zelda, Hogwarts Legacy, Diablo, Spider-Man, etc – are performing better than ever, while more and more players are pouring the majority of their time into live services. It seems harder than ever to have a hit outside the AAA space, which is where the majority of Embracer's studios operate. Even its biggest release in years, the 2022 revival of Saints Row, failed to meet expectations.

In such a climate, how does a business decide which of its 200+ in-development games are worth continuing?

The return of Saints Row was the biggest release from an Embracer company in years, but it still failed to meet sales expectations

"First and foremost, we look at entertainment values," says Rogers. "It has to be fun to play. I'm never a big fan of the 'fewer bigger, better' [approach]. Bigger games aren't always fun. I know how hard it is to make smaller games and to bring those entertainment values to bear from experience at Crystal when we started working on digital spin-outs of Lara Croft. For Lara Croft and the Temple of Osiris, that was a AAA team trying to make a game with much, much smaller budgets. So many teams are producing games today for much, much smaller budgets.

"Then we do look at how we would assess the commercial outcomes, how we squint and would see those returns. There's the potential for genres as well, where we've got overlap in potential genres or whatnot… That would help us make some decisions. "It also helps us explain decisions with teams. One of the softer but very clear advantages of going through this process I found is it really has got teams to work together to share, to discuss, and that's helped us then with those decisions when we've had to deliver them."

For Rogers, that strategy was built on the ambition to position Embracer as an industry leader and the company wants to maintain that leadership position.

"Establishing ourselves within the the industry… [Embracer is] a relatively new player, but then in other aspects, Embracer has been around for a while," he says. "But its emergence amongst the leadership in the industry has been a very fast ascent."

Rogers brings an interesting perspective to the matter. Having only joined Embracer last year, he saw that very fast ascent from an external point of view, and now he's seeing the next chapter internally. When asked what led Embracer to this point, he relates it to the wider games business and its rapid growth.

"We're a super-confident industry, a boundary-pushing industry," he explains. "I joined in 1999 with the belief that physics middleware was gonna revolutionise gameplay, and now I realise it's just a component of how games are designed and enjoyed. This is an industry that's always taking on and facing challenges, always looking for opportunities, entertaining billions of people around the world, and it's growing…I think I recognise all of that within Embracer."

He continues: "[But] part of that confidence means that at times, we have to change and adapt. You know, the macro forces and micro forces. I think that's the situation that the industry is in right now. We've taken on a lot, but it's in that pursuit to change and evolve and grow, and now we're just in that different climate. And I think that maps across absolutely with Embracer. It is a very confident and can-do organisation, but now we just got to face some of the realities of how we can work in a more efficient way."

We bring the conversation back to what the group's goals are, what 'winning' looks like to Embracer, to which Rogers responds: "These are all questions we are going to come back to and address in full. We're very focused right now on the restructuring, So I don't think these are questions we are in a position to answer today. He continues "We are very focused on the restructuring. I think it is a very galvanising time for us. Personally, I think we learn more about ourselves in tough times. It's when you really have to think deeply and without any complacency. And I said today, we try and bring people together in this focused programme now, and [we] will come out with that meta vision as we get into 2024."

Embracer owns a lot of valuable IP, including Tomb Raider and The Lord of the Rings

As Embracer stated in its financial report, the restructure is still in its "early stages," which means more layoffs and studio closures are expected. How many more is still unclear.

"It's always a tricky question," says Rogers. "We report to the quarter, and we're mindful that the operative groups are making changes. Some of that makes the news, and some of it doesn't. We don't comment on that, but we will report on it as we get to those quarterly measurement dates, so the next time will be in February.

Embracer also has spent much of the past five months reassessing the inefficiencies that brought the business to this point. From the outside in, it's fairly easy to suggest an aggressive M&A strategy of nearly 90 purchases in six years is the primary factor – especially without major hits from the studios it does own to help sustain a group of this size.

"Our priorities are… very much keeping a focus on working together, keeping eyes on the goal at a project level. We have announced that we expect more restructuring and some more cancellations, potentially some more closures or management buyouts. That's the balance we've got to take internally… Because, as we say, the people cost is significant, and it's significant to us and we have to handle that always with that respect and integrity."

Rogers concludes by reiterating that Embracer is very much focused on looking forward, and while it's adjusting how it operates, the company's long-term vision is still unchanged.

"We have a solid foundation with predictable, profitable, and cash-generative businesses, including a roster of renowned PC/Console franchises that gradually grow stronger," he says. "The demand for content has never been greater, and we are well-positioned to leverage that demand. We have fantastic people and many world-class IPs, and we aim to demonstrate the growing earnings power of this combination over time."