How many copies should it sell to refuse shaving beard for another couple of years?I did quit my job to focus on the game, but unless AoD sells well enough to support me for the next 2 years, I'll be forced to shave off my beard, put on a suit and go back.

-

Welcome to rpgcodex.net, a site dedicated to discussing computer based role-playing games in a free and open fashion. We're less strict than other forums, but please refer to the rules.

"This message is awaiting moderator approval": All new users must pass through our moderation queue before they will be able to post normally. Until your account has "passed" your posts will only be visible to yourself (and moderators) until they are approved. Give us a week to get around to approving / deleting / ignoring your mundane opinion on crap before hassling us about it. Once you have passed the moderation period (think of it as a test), you will be able to post normally, just like all the other retards.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Unhealthy interest in sales figures

- Thread starter t

- Start date

himmy

Arcane

I'll be forced to shave off my beard

My prayers go out for you.

Vault Dweller

Commissar, Red Star Studio

- Joined

- Jan 7, 2003

- Messages

- 28,059

No idea. It depends on how much will be left after taxes, if I have to pay any US taxes*, etc.How many copies should it sell to refuse shaving beard for another couple of years?I did quit my job to focus on the game, but unless AoD sells well enough to support me for the next 2 years, I'll be forced to shave off my beard, put on a suit and go back.

*I had to "open an account" with the IRS (alternatively, Valve would have to withhold another 30% and file them as taxes) and then after I file corporate taxes in Canada and I'd have to file them in the US (I guess to show that I did pay and hope that the IRS agrees that I paid enough). Then I'd have pay myself as an employee and pay taxes on that.

No idea. It depends on how much will be left after taxes, if I have to pay any US taxes*, etc.How many copies should it sell to refuse shaving beard for another couple of years?I did quit my job to focus on the game, but unless AoD sells well enough to support me for the next 2 years, I'll be forced to shave off my beard, put on a suit and go back.

*I had to "open an account" with the IRS (alternatively, Valve would have to withhold another 30% and file them as taxes) and then after I file corporate taxes in Canada and I'd have to file them in the US (I guess to show that I did pay and hope that the IRS agrees that I paid enough). Then I'd have pay myself as an employee and pay taxes on that.

Wow, this seems even more complicated that Russian tax system... or I just got used to it.

Anyway, let's cross our fingers for the success of Incline

Vault Dweller

Commissar, Red Star Studio

- Joined

- Jan 7, 2003

- Messages

- 28,059

It's not that complicated, but it's subject to a lot of interpretation and since I'm new at it, I have no idea what works and what doesn't.

There is a tax treaty between Canada and the US. So the US won't insist on me paying taxes in the US provided I paid them in Canada, so I have to file my return in the US to prove that I did. Whether or not it's just a formality remains to be seen. For example, if I end up paying only 5 or 10%, for argument's sake, would the IRS accept it or would they insist that it should be higher to meet some minimum rate?

The main question is the taxable income. My team members are contractors, as none of them is on salary or live in Canada. So, basically, I claim that only 25% of revenues is taxable income (let's ignore the other expenses to keep things simple), which may raise a few eyebrows. So, after all corporate taxes are agreed and paid, I have what's basically my share sitting in the corporate account. I can't just take the money. They can be paid out either as dividends or salary. Both are taxable. I can reimburse expenses, but again it's unclear (due to the nature of the business) which expenses would be allowed. For example, normally you can write off car lease, which is what I've always done in the past, but before I had work-related reasons to drive around. Now I don't. Etc.

There is a tax treaty between Canada and the US. So the US won't insist on me paying taxes in the US provided I paid them in Canada, so I have to file my return in the US to prove that I did. Whether or not it's just a formality remains to be seen. For example, if I end up paying only 5 or 10%, for argument's sake, would the IRS accept it or would they insist that it should be higher to meet some minimum rate?

The main question is the taxable income. My team members are contractors, as none of them is on salary or live in Canada. So, basically, I claim that only 25% of revenues is taxable income (let's ignore the other expenses to keep things simple), which may raise a few eyebrows. So, after all corporate taxes are agreed and paid, I have what's basically my share sitting in the corporate account. I can't just take the money. They can be paid out either as dividends or salary. Both are taxable. I can reimburse expenses, but again it's unclear (due to the nature of the business) which expenses would be allowed. For example, normally you can write off car lease, which is what I've always done in the past, but before I had work-related reasons to drive around. Now I don't. Etc.

likaq

Arcane

- Joined

- Dec 28, 2009

- Messages

- 1,198

*I had to "open an account" with the IRS (alternatively, Valve would have to withhold another 30% and file them as taxes) and then after I file corporate taxes in Canada and I'd have to file them in the US (I guess to show that I did pay and hope that the IRS agrees that I paid enough). Then I'd have pay myself as an employee and pay taxes on that.

US taxation system at its finest.

USA = land of the free

Oh wait.

Vault Dweller

Commissar, Red Star Studio

- Joined

- Jan 7, 2003

- Messages

- 28,059

You're free to earn money for the government in the manner of your choosing.

You're free to earn money for the government in the manner of your choosing.

You have no idea....

It's not that complicated, but it's subject to a lot of interpretation and since I'm new at it, I have no idea what works and what doesn't.

There is a tax treaty between Canada and the US. So the US won't insist on me paying taxes in the US provided I paid them in Canada, so I have to file my return in the US to prove that I did. Whether or not it's just a formality remains to be seen. For example, if I end up paying only 5 or 10%, for argument's sake, would the IRS accept it or would they insist that it should be higher to meet some minimum rate?

The main question is the taxable income. My team members are contractors, as none of them is on salary or live in Canada. So, basically, I claim that only 25% of revenues is taxable income (let's ignore the other expenses to keep things simple), which may raise a few eyebrows. So, after all corporate taxes are agreed and paid, I have what's basically my share sitting in the corporate account. I can't just take the money. They can be paid out either as dividends or salary. Both are taxable. I can reimburse expenses, but again it's unclear (due to the nature of the business) which expenses would be allowed. For example, normally you can write off car lease, which is what I've always done in the past, but before I had work-related reasons to drive around. Now I don't. Etc.

Why doesn't Valve move it's servers to someplace else, like where all pirates have/had their servers (Ukraine for instance*) , so they don't have to force their developers, who are around the world, to pay US taxes?

*Yes I know Demonoid got raided in Ukraine. But that was an illegal piracy site. Valve would be a legal business that moved offshore

bat_boro

Arcane

- Joined

- Nov 22, 2006

- Messages

- 1,551

Vault Dweller, you should relocate to Bulgaria bro. Seriously, you will pay 10% tax and with the money you made you will live for 2 years in a 200 sq meters condo.

No but seriously fingers crossed for you bro. I think that sales will surge after you release the full game. I think I am not alone in waiting for the game to come out before buying it.

No but seriously fingers crossed for you bro. I think that sales will surge after you release the full game. I think I am not alone in waiting for the game to come out before buying it.

tuluse

Arcane

- Joined

- Jul 20, 2008

- Messages

- 11,400

It doesn't really matter where the servers are. Valve is incorporated in the US.Why doesn't Valve move it's servers to someplace else, like where all pirates have/had their servers (Ukraine for instance*) , so they don't have to force their developers, who are around the world, to pay US taxes?

*Yes I know Demonoid got raided in Ukraine. But that was an illegal piracy site. Valve would be a legal business that moved offshore

If they weren't, well then every sale would be an import and things would get really messy. I wonder how GOG handles it now that I think about it.

Ninjerk

Arcane

- Joined

- Jul 10, 2013

- Messages

- 14,323

I think more than once my CC company declined charges from GOG because it came through Cyprus or something like that.It doesn't really matter where the servers are. Valve is incorporated in the US.Why doesn't Valve move it's servers to someplace else, like where all pirates have/had their servers (Ukraine for instance*) , so they don't have to force their developers, who are around the world, to pay US taxes?

*Yes I know Demonoid got raided in Ukraine. But that was an illegal piracy site. Valve would be a legal business that moved offshore

If they weren't, well then every sale would be an import and things would get really messy. I wonder how GOG handles it now that I think about it.

Vault Dweller

Commissar, Red Star Studio

- Joined

- Jan 7, 2003

- Messages

- 28,059

I don't think so because it doesn't apply to digital goods in North America.If they weren't, well then every sale would be an import and things would get really messy. I wonder how GOG handles it now that I think about it.

Either way, I'm not saying that all developers are forced to pay taxes. Maybe we're forced to submit a return because of the tax agreement between the US and Canada. It's possible that showing that we did file our return and paid taxes will be enough but at this point I don't know.

tuluse

Arcane

- Joined

- Jul 20, 2008

- Messages

- 11,400

Yeah I figure it will either work like that or you have to calculate your US taxes too and then if they're higher you'd have to pay the difference.I don't think so because it doesn't apply to digital goods in North America.

Either way, I'm not saying that all developers are forced to pay taxes. Maybe we're forced to submit a return because of the tax agreement between the US and Canada. It's possible that showing that we did file our return and paid taxes will be enough but at this point I don't know.

Vault Dweller

Commissar, Red Star Studio

- Joined

- Jan 7, 2003

- Messages

- 28,059

That's what I'm afraid of.Yeah I figure it will either work like that or you have to calculate your US taxes too and then if they're higher you'd have to pay the difference.I don't think so because it doesn't apply to digital goods in North America.

Either way, I'm not saying that all developers are forced to pay taxes. Maybe we're forced to submit a return because of the tax agreement between the US and Canada. It's possible that showing that we did file our return and paid taxes will be enough but at this point I don't know.

- Joined

- May 8, 2007

- Messages

- 470

That all depends on the exact tax treaty, unfortunately. And it always written in lawyerese so normal folks can't understand it. You might want to consult a tax consultant (for more money, of course).

Edit: If you're a US citizen you always have to pay US taxes of course

Edit: If you're a US citizen you always have to pay US taxes of course

- Joined

- Sep 7, 2013

- Messages

- 6,340

It's not that complicated, but it's subject to a lot of interpretation and since I'm new at it, I have no idea what works and what doesn't.

There is a tax treaty between Canada and the US. So the US won't insist on me paying taxes in the US provided I paid them in Canada, so I have to file my return in the US to prove that I did. Whether or not it's just a formality remains to be seen. For example, if I end up paying only 5 or 10%, for argument's sake, would the IRS accept it or would they insist that it should be higher to meet some minimum rate?

The main question is the taxable income. My team members are contractors, as none of them is on salary or live in Canada. So, basically, I claim that only 25% of revenues is taxable income (let's ignore the other expenses to keep things simple), which may raise a few eyebrows. So, after all corporate taxes are agreed and paid, I have what's basically my share sitting in the corporate account. I can't just take the money. They can be paid out either as dividends or salary. Both are taxable. I can reimburse expenses, but again it's unclear (due to the nature of the business) which expenses would be allowed. For example, normally you can write off car lease, which is what I've always done in the past, but before I had work-related reasons to drive around. Now I don't. Etc.

Why doesn't Valve move it's servers to someplace else, like where all pirates have/had their servers (Ukraine for instance*) , so they don't have to force their developers, who are around the world, to pay US taxes?

*Yes I know Demonoid got raided in Ukraine. But that was an illegal piracy site. Valve would be a legal business that moved offshore

Because:

(1) all of the best personnel and infrastructure for maintaining data centers are on the West Coast.

(2) red rape entailed with moving a multi-billion dollar business overseas -- there's reason why 100% free trade agreements like NAFTA are a big deal.

Ninjerk

Arcane

- Joined

- Jul 10, 2013

- Messages

- 14,323

Nevermind that no one is going to be invading or blowing things up in Seattle any time soon lolIt's not that complicated, but it's subject to a lot of interpretation and since I'm new at it, I have no idea what works and what doesn't.

There is a tax treaty between Canada and the US. So the US won't insist on me paying taxes in the US provided I paid them in Canada, so I have to file my return in the US to prove that I did. Whether or not it's just a formality remains to be seen. For example, if I end up paying only 5 or 10%, for argument's sake, would the IRS accept it or would they insist that it should be higher to meet some minimum rate?

The main question is the taxable income. My team members are contractors, as none of them is on salary or live in Canada. So, basically, I claim that only 25% of revenues is taxable income (let's ignore the other expenses to keep things simple), which may raise a few eyebrows. So, after all corporate taxes are agreed and paid, I have what's basically my share sitting in the corporate account. I can't just take the money. They can be paid out either as dividends or salary. Both are taxable. I can reimburse expenses, but again it's unclear (due to the nature of the business) which expenses would be allowed. For example, normally you can write off car lease, which is what I've always done in the past, but before I had work-related reasons to drive around. Now I don't. Etc.

Why doesn't Valve move it's servers to someplace else, like where all pirates have/had their servers (Ukraine for instance*) , so they don't have to force their developers, who are around the world, to pay US taxes?

*Yes I know Demonoid got raided in Ukraine. But that was an illegal piracy site. Valve would be a legal business that moved offshore

Because:

(1) all of the best personnel and infrastructure for maintaining data centers are on the West Coast.

(2) red rape entailed with moving a multi-billion dollar business overseas -- there's reason why 100% free trade agreements like NAFTA are a big deal.

Black

Arcane

- Joined

- May 8, 2007

- Messages

- 1,873,196

I need to know more about this one.red rape

- Joined

- Sep 7, 2013

- Messages

- 6,340

I need to know more about this one.red rape

When your accounting is in the red, financially speaking, we call it 'red rape' -- because your finances are getting raped. In this case, I was referring to the costs associated with moving hundreds of millions of dollars of infrastructure overseas.

Actually meant red tape

Chairman Yang

Novice

- Joined

- Jun 21, 2007

- Messages

- 3

My gut tells me that AoD is going to sell remarkably well, and significantly above Vince's expectations--eventually. The game's super-ugly (aside from the amazing portraits), clearly unfinished, difficult to show off or explain, and with a clunky UI, but there's something incredibly unique and special at its core. It has superb, authentic-feeling, wonderfully cynical writing combined with choice and consequence that's possibly unparalleled by any other game.

When the game IS finished and out of Early Access, it's going to get a burst of reviews and player impressions, and possibly some good Youtube plays that will go some way towards selling it (and if not, Vince should make a few himself). If there are some compact, easily-digestible videos that show off the supreme dickery possible in this game, I can see some of them going mildly viral and appealing to the Crusader Kings 2/Game of Thrones crowd. And once people realize that this game is really meant for multiple, radically-different playthroughs rather than going through a single, mostly-linear story with minor variations, that's going to stimulate Youtubers to do repeat plays.

One word of warning: I would advise Vince to make a big push all at once when the game is polished and out of Early Access, rather than making lots of small pushes over time. There's a limited number of times the media is going to talk about the game (although this will vary from outlet to outlet and from Youtuber to Youtuber). He shouldn't squander the initially precious and limited exposure he's going to get.

When the game IS finished and out of Early Access, it's going to get a burst of reviews and player impressions, and possibly some good Youtube plays that will go some way towards selling it (and if not, Vince should make a few himself). If there are some compact, easily-digestible videos that show off the supreme dickery possible in this game, I can see some of them going mildly viral and appealing to the Crusader Kings 2/Game of Thrones crowd. And once people realize that this game is really meant for multiple, radically-different playthroughs rather than going through a single, mostly-linear story with minor variations, that's going to stimulate Youtubers to do repeat plays.

One word of warning: I would advise Vince to make a big push all at once when the game is polished and out of Early Access, rather than making lots of small pushes over time. There's a limited number of times the media is going to talk about the game (although this will vary from outlet to outlet and from Youtuber to Youtuber). He shouldn't squander the initially precious and limited exposure he's going to get.

Vault Dweller

Commissar, Red Star Studio

- Joined

- Jan 7, 2003

- Messages

- 28,059

Patience is a virtue or so I hear.My gut tells me that AoD is going to sell remarkably well, and significantly above Vince's expectations--eventually.

Thanks.The game's super-ugly (aside from the amazing portraits), clearly unfinished, difficult to show off or explain, and with a clunky UI, but there's something incredibly unique and special at its core. It has superb, authentic-feeling, wonderfully cynical writing combined with choice and consequence that's possibly unparalleled by any other game.

Since the game is text-heavy, it's not really a Youtube-friendly game to show others. Most youtubers simply ended up reading what's on the screen which isn't very exciting, except for that one time when a girl nearly had an orgasm from the above mentioned dickery.When the game IS finished and out of Early Access, it's going to get a burst of reviews and player impressions, and possibly some good Youtube plays that will go some way towards selling it (and if not, Vince should make a few himself). If there are some compact, easily-digestible videos that show off the supreme dickery possible in this game, I can see some of them going mildly viral and appealing to the Crusader Kings 2/Game of Thrones crowd. And once people realize that this game is really meant for multiple, radically-different playthroughs rather than going through a single, mostly-linear story with minor variations, that's going to stimulate Youtubers to do repeat plays.

hivemind

Guest

Should use that one for some marketing.

Age of decadence.

-May or may not make your girl orgasm.

guaranteed sales

Age of decadence.

-May or may not make your girl orgasm.

guaranteed sales

I'm afraid I don't share your optimism CY even though I'm the (self-proclaimed) biggest AoD fan there is.

It always amazes me that most people look at the score in game reviews instead of what's actually written in the review, either because they're too lazy or because they can't read with comprehension and make logical conclusions themselves (the latter is more common).

Anyway, the score will definitely be lowered because the graphics isn't as good as in Skyrim and the music while great is scanty (i.e. not every location has its own score, there's basically a Menu music, Teron music and Maadoran music and that's it). Also, some people may be put off by skill checks (if someone is trying to go the easy way and spends the points the moment he receives them he might be irritated that his skill wasn't high enough at certain moment) and some other tiny things (like not many keyboard shortcuts, although this might change in 1.0 version). But this all isn't really a problem

to me.

BTW, it also amazes me that so few people know what weighted mean is. To me enjoyment of gameplay has way more weight than graphics or sound. So even though AoD has quite a few flaws I would still rate it 10/10 (more like 9.9999996 if I was taking graphics and other things into account) because it's a game I've had most fun with (along with Fallout 1 and Sacrifice). It basically doesn't bore me and I've played it more times than Fallout 1 already. The writing is superb and I dare to say that it's better than P:T writing if only because actions of people feel more real and reasonable in the world they're in and everything is so consistent. Also, every character with a name here is memorable which is not the case even in Fallout 1 (on the other hand only handful of P:T characters were great and everything revolved around Nameless One). Militiades and Neloes are my favourites.

Another issue people might have with it is game length and when reviewer will mention about it it will definitely repel people. It will be unfair though because: http://steamcommunity.com/app/230070/discussions/0/617328415055024585/#c617328415055968961

Yeah, the problem is that most people are too stupid to look past the visuals and notice how great the writing, characters and gameplay (fights, C&C, etc.) are.My gut tells me that AoD is going to sell remarkably well, and significantly above Vince's expectations--eventually. The game's super-ugly (aside from the amazing portraits), clearly unfinished, difficult to show off or explain, and with a clunky UI, but there's something incredibly unique and special at its core. It has superb, authentic-feeling, wonderfully cynical writing combined with choice and consequence that's possibly unparalleled by any other game. (...)

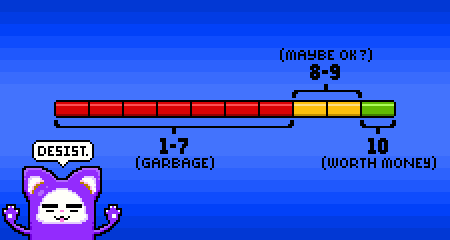

It's going to be a burst of reviews all right, except most of them will probably have a 7/10 score which means this for retards (i.e. most gamers):(...) When the game IS finished and out of Early Access, it's going to get a burst of reviews and player impressions, and possibly some good Youtube plays that will go some way towards selling it (and if not, Vince should make a few himself). (...)

It always amazes me that most people look at the score in game reviews instead of what's actually written in the review, either because they're too lazy or because they can't read with comprehension and make logical conclusions themselves (the latter is more common).

Anyway, the score will definitely be lowered because the graphics isn't as good as in Skyrim and the music while great is scanty (i.e. not every location has its own score, there's basically a Menu music, Teron music and Maadoran music and that's it). Also, some people may be put off by skill checks (if someone is trying to go the easy way and spends the points the moment he receives them he might be irritated that his skill wasn't high enough at certain moment) and some other tiny things (like not many keyboard shortcuts, although this might change in 1.0 version). But this all isn't really a problem

to me.

BTW, it also amazes me that so few people know what weighted mean is. To me enjoyment of gameplay has way more weight than graphics or sound. So even though AoD has quite a few flaws I would still rate it 10/10 (more like 9.9999996 if I was taking graphics and other things into account) because it's a game I've had most fun with (along with Fallout 1 and Sacrifice). It basically doesn't bore me and I've played it more times than Fallout 1 already. The writing is superb and I dare to say that it's better than P:T writing if only because actions of people feel more real and reasonable in the world they're in and everything is so consistent. Also, every character with a name here is memorable which is not the case even in Fallout 1 (on the other hand only handful of P:T characters were great and everything revolved around Nameless One). Militiades and Neloes are my favourites.

Another issue people might have with it is game length and when reviewer will mention about it it will definitely repel people. It will be unfair though because: http://steamcommunity.com/app/230070/discussions/0/617328415055024585/#c617328415055968961

Vault Dweller

Commissar, Red Star Studio

- Joined

- Jan 7, 2003

- Messages

- 28,059

I don't think the gaming sites will rush to review the game (in general the sites review what other people want to read about, i.e. popular games), but yeah, I don't see reviews getting higher than 7/10 IF we're lucky.It's going to be a burst of reviews all right, except most of them will probably have a 7/10 score which means this for retards (i.e. most gamers):

Exhibit A:

http://attackofthefanboy.com/reviews/age-decadence-review/

1/5

![Glory to Codexia! [2012] Codex 2012](/forums/smiles/campaign_tags/campaign_slushfund2012.png)